On July 9th 2024, the President of the Republic of Ireland, signed a bill that had passed both houses of parliament, the Dáil and the Seanad (house and senate); the Automatic Enrolment Retirement Savings System Bill 2024 (Bill 22 of 2024). More than 20 years in the making, this new legislation will have implications for both employers and employees in the Republic of Ireland, even where an employer currently operates and offers membership of an occupational pension scheme or Personal Retirement Savings Account (PRSA).

This change and its impact should not be understated, and preparation is now necessary by employers for this implementation and decisions will need to be made regarding their pension / retirement planning offerings to their employees.

What does this mean once implemented (expected 2025) and who will be impacted ?

All employees aged between 23 and 60, earning €20,000 annually from all employments will fall into the scope of automatic enrolment (AE). Those outside of these ages may also opt in.

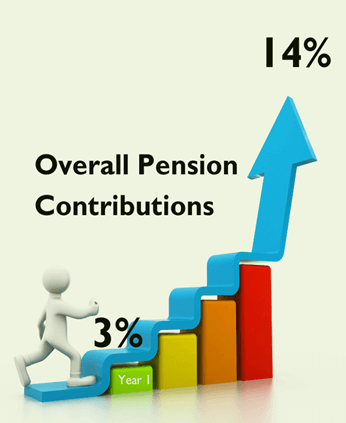

The contributions that will require to be made in month 1 of implementation will be 1.5% Employer and 1.5% Employee (of total earnings). With employee gross equivalent contribution taken from net pay. Employer contribution will have no tax implication for the employee, the employee contribution, unlike current DC savings available through the private sector, will not be tax relieved – instead it will be topped up with a 0.5% Government contribution. Over 10 years from implementation, the percentages will increase to an overall 14% combined, with 6% Employer, 6% Employee and 2% Government.

NB Any employee in exempt employment will not be automatically enrolled in the Government System, once implemented. Who is deemed exempt; an employee who is in the AE scope will not be pulled into the government scheme where they are currently making a pension contribution via payroll – of any kind – this can be employer only, employee only or a combination of the two. If they stop contributing to a current arrangement at any time they will be brought into AE, and must wait 6 months to opt out, or recommence / join a pension at which point they will be in exempt employment again.

The new National Automatic Enrolment Retirement Savings Authority (NAERSA) will not review standards in relation to current schemes until year 6 of operation. So at commencement any contribution will do for exemption.

What steps do employers need to take?

Consult with their broker to undertake the following;

- Review current pension arrangements (if any), and philosophy to this benefit.

- Review current scheme membership to determine the % of employees that would be impacted by AE (if any) and what the cost implications are if they wish to move to 100% participation in their own scheme.

- Review potential cost of AE if no scheme in place.

- Determine a course of action; to enable them to ensure they do not have to participate with AE if they choose not to; to decide if they will let two schemes operate AE and their own; if nothing in place – take action to put a scheme in place or simply allow AE to consume their employees into the Government system.

What’s happening now?

The AE system is coming; expected to be in operation commencing end of September 2025. The Government has appointed Tata Consulting Services (TCS) to build its platform. The NAERSA entity requires to be established and staffed. The RFP for AE’s Investment fund managers has yet to be issued and up to 4 selected.

Next steps for employers to consider;

- Talk to a broker – it would be important to take stock now, understand and review what your competitors are doing in this space in order to continue to attract and retain your own employees. Pension saving in Ireland will be spoken about more than ever before once the mass communication campaign commences, with employees comparing and contrasting.

- Develop your AE strategy and be prepared to move forward once the implementation date is known.

- Manage communications with your employees in Ireland as implementation nears, with your broker’s support.

Davin Spollen is Chief Executive Officer of Glennon Employee Benefits and current President of the Irish Institute of Pensions Management (IIPM). Davin is an Associate of the IIPM, Qualified Pension Trustee and Certified Financial Planner.

If you / your clients require any assistance in Ireland please reach out to Davin and his team employeebenefits@glennons.ie